Hong Kong Fintech Week

Organized by InvestHK, a HKSAR government department, supported by the Hong Kong Monetary Authority (HKMA), the Securities and Futures Commission (SFC), the Insurance Authority (IA) and the Hong Kong Stock Exchange (HKEX), and with AMTD Group as the sole strategic partner, Hong Kong Fintech Week 2019 took place from November 4th to 8th in Hong Kong and Shenzhen. This is the second year in a row that AMTD Group serves as a sole strategic partner for Hong Kong Fintech Week.

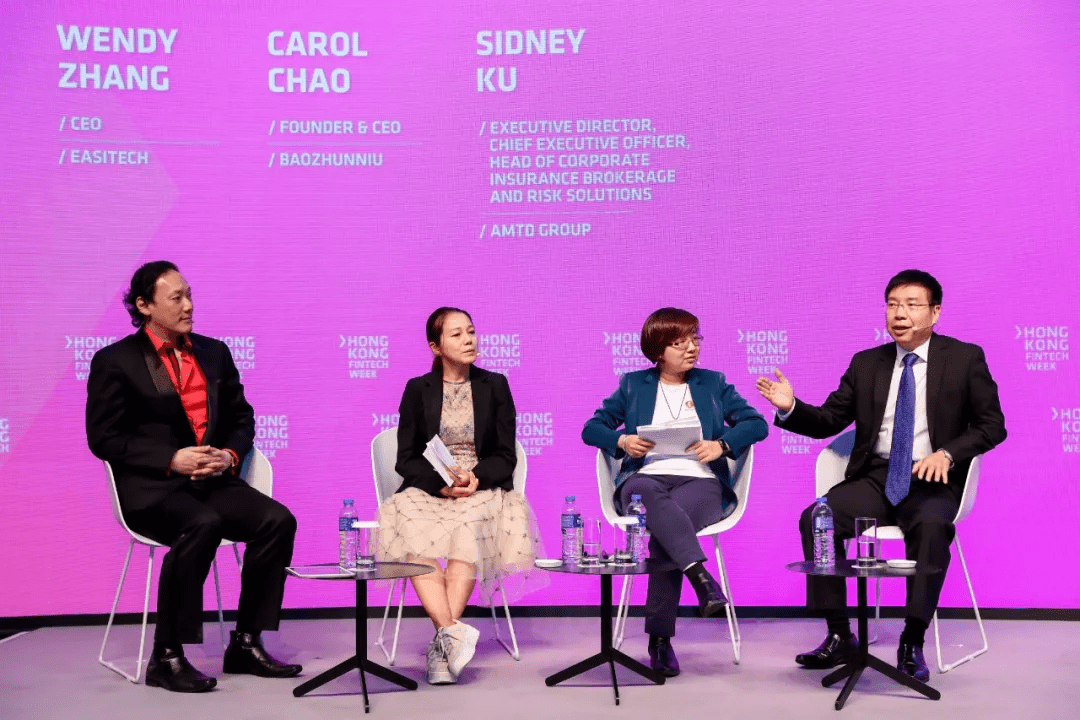

During Hong Kong Fintech Week, three insurance experts, Sidney Ku, Chief Executive Officer and Head of Corporate Insurance Brokerage of AMTD Strategic Capital Group, Wendy Zhang, Chief Executive Office of EasiTech, a subsidiary of Doubao Network, and Carol Chao, Founder and Chief Executive Officer of Baozhunniu, together discussed the growing trend of Chinese insurance industry in the post-digital era at the Growth Stage. The panel discussion was moderated by King Leung, Head of Fintech of Invest Hong Kong.

Insurtech: Shaping the Global Business Landscape

Sidney Ku, Chief Executive Officer and Head of Corporate Insurance Brokerage of AMTD Strategic Capital Group, the largest local corporate insurance brokerage and risk solutions firm in Hong Kong, pointed out that the development of Chinese insurance industry is currently at a critical stage of transformation and will be more competitive after technology empowers traditional insurance companies. It is widely considered in the Chinese insurance industry that the IT application level of insurance is ten to twenty years behind the banking industry. However, in terms of volume, basic position, impact on other industries and the richness of the scene of the insurance industry, the development potentials for technology applications are still broad. The driving forces of the Internet to the insurance industry are mainly reflected in four aspects: improving information transparency, building a disintermediated online selling platform, meeting new demands and promoting more convenient and comprehensive service model.

Wendy Zhang, Chief Executive Office of EasiTech, a subsidiary of Doubao Network, is mainly responsible for the overseas business of Doubao Network. She mentioned that the pain point of the insurance industry is the lack of specialization, and with the consumption patterns of “Payment First, Service Later” in the industry, professional third-party organizations are needed to help and support policy-holders, while technology can empower the industry. Thus Doubao Network emerged as the times require, committed to the insurance industry to enable technology and services, using big data, artificial intelligence and other technologies to conduct data mining for online insurance, policy administration, preservation, claims, health conditions and other consumer behaviors; understanding customer needs and services for intermediary agents and developing products for insurance companies.

Carol Chao, Founder and Chief Executive Officer of Baozhunniu, has a technical background and has acute sense of the importance of technology in the insurance industry. With Internet thinking, Carol started to enter the insurance industry by offering ToB services and established Baozhunniu, which is now the leading global insurtech and data-driven insurance customized platform in China. Currently, Baozhunniu has customized thousands of kinds of insurance for more than ten industries, covering health care, sharing economy, sports, human resources, O2O, travel, education, tourism, catering, property and other related fields. It has empowered nearly 8,000 enterprise customers and served over 150 million customers, covering more than 200 cities at home and abroad.

Science and Technology Aids China’s Inclusive Insurance

In 2016, the State Council of the People’s Republic of China published the Plan for Advancing Inclusive Finance Development (2016-2020), emphasized on improving the breadth and depth of inclusive finance by innovating financial products and services. Inclusive finance is the trend of the times in China, and insurtech is the driving engine for the development of inclusive insurance. Sidney Ku expressed that in terms of breadth, China’s insurance market is currently concentrated in affluent provinces; in terms of depth, China’s overall per capita insurance premium is relatively low, which is apparently behind the developed countries. Hence for insurance institutions, they need to expand the coverage of customers from the breadth, increase insurance coverage from the depth, and provide better quality services for the realization of inclusive insurance. The application and innovation of insurtech play a significant role in such realization. Wendy Zhang further pointed out that the emerging digital insurance enterprises can catch the needs of users, strengthen product development, and make use of Internet and big data for customer insight. Carol Chao also indicated that the design of insurance products should be user-oriented and should identify the rigid needs accurately; as many customers have urgent needs, while the traditional insurance companies are unable to satisfy such kind of demand; it is important to explore how to use personalized product, humanized service, and traditional insurance supply-side to form complementary advantages to solve the security needs of customers and the underserved.

A Golden Opportunity for Cross-Border Insurance in the Greater Bay Area

At the end of the discussion panel, Sidney Ku said that all industries in the Greater Bay Area will bring new economic development opportunities to the bay area, benefiting from the “2+9” urban agglomeration of about 70 million people, including the insurance industry. Support from the insurance industry for the Greater Bay Area was mentioned in the recent issued Outline Development Plan of the Central Government and the State Council for the Guangdong-Hong Kong-Macao Greater Bay Area. This is a golden opportunity for the insurance industry. AMTD Strategic Capital Group as the largest local corporate insurance brokerage and risk solutions firm in Hong Kong, will always be committed to gathering the strength of the industry, promoting the healthy development of the industry, and jointly creating a new pattern of Asian insurance industry.