On the third day of HK Fintech Week 2020, William Fung, Group Vice President of AMTD Group and CEO of AMTD International, was invited to speak on the panel “Fundraising & Exit, Leveraging GBA as the Lubricant to Level-up China’s Cross-border Finance”, together with Jianping Wang, Managing Director of Greater Bay Area Homeland Investments. Bohui Zhang, Executive Associate Dean of School of Management and Economics of CUHK (Shenzhen), moderated this panel.

William Fung, Group Vice President of AMTD Group and CEO of AMTD International (Top right), Jianping Wang, Managing Director of Greater Bay Area Homeland Investments (Top left) and Bohui Zhang, Executive Associate Dean of School of Management and Economics of CUHK (Shenzhen) (Bottom)

Following the “Opinions Concerning Financial Support for the Establishment of the Guangdong-Hong Kong-Macau Greater Bay Area” released by the People’s Bank of China (PBOC) and three other regulatory authorities this May, China has recently promulgated a series of policies to promote the development of GBA. William Fung mentioned that AMTD has obtained the approval from the Zhuhai Municipal Finance Bureau to establish a QFLP fund with Xiaomi Corporation. By embracing national policies, AMTD will better connect funds and investment opportunities domestically and abroad, broaden the fundraising channels and contribute to the development of China’s cross-border finance.

When discussing about the potential innovation in cross-border finance, William Fung pointed out that the virtual bank is a significant breakthrough in financial innovation. Airstar Bank, the virtual bank jointly established by AMTD and Xiaomi, owns one of the eight virtual banking licenses granted by Hong Kong Monetary Authority and has launched full operation this June, aiming at serving local citizens and supporting the businesses. In the future, AMTD plans to expand the virtual banking business to all of GBA and benefit more people and enterprises. Being an active investor in InsurTech, AMTD also looks forward to bringing valuable experience to domestic market and exchanging industry know-how with other market participants. The attendees also explored innovative exit ways outside of conventional routes such as acquisition, transfer and initial public offering. William Fung mentioned that CapBridge Financial, Singapore’s leading integrated private market ecosystem and first regulated securities exchange for private companies under AMTD, can provide liquidity in the private market and unlock the value for investors. Jianping Wang, Managing Director of Greater Bay Area Homeland Investments, added that GBA has a unique location that allows it to easily access not only Shenzhen Stock Exchange and the Stock Exchange of Hong Kong, but also oversea capital markets, which provides diversified options to maximize shareholders’ value.

On the same day, Michelle Li, CEO of AMTD Digital, hosted a panel discussion on “Open Blockchain Platform Application and Outlook”. Huiya Yao, Head of FinTech Innovation of WeBank and Deputy Secretary-General of FISCO; Chao Wang, Deputy General Manager, R&D Center of Forms Syntron joined and shared their insights into open blockchain platform application and outlook.

Michelle Li, CEO of AMTD Digital (left), Chao Wang, Deputy General Manager, R&D Center of Forms Syntron (middle), Huiya Yao, Head of FinTech Innovation of WeBank and Deputy Secretary-General of FISCO (right)

Michelle started the discussion with a brief introduction of AMTD Digital, the digital solutions arm of AMTD Group. The company engages in digital financial services, digital marketing and data intelligence, digital connectors and ecosystem building, and digital investments. AMTD highly values the technology innovation, and it is committed to connecting Asian and global markets with innovative idea and cutting-edge technology, achieving cross-border, cross-regional, and cross-sector synergies and technical interoperability.

| Explosion of blockchain-based solutions

“Different from many western countries, China has been promoting blockchain as a FinTech technology, as opposed to cryptocurrency.” said Mr. Yao. After going through three phases of development, blockchain is already playing a big role across China’s economy and moving into an early stage of commercialization. Applications of blockchain in different areas, such as financing, cross-border remittances, license and patent protection, online dispute and arbitration, benign exit system for online loans, mutual recognition system of health code, is becoming more and more mature.

Panelists also discussed China’s central bank digital currency (CBDC). Mr. Yao and Mr. Wang pointed out the potential applications of blockchain in the second layer of the CBDC’s two-tiered structured system, the one connects the commercial banks with the retail market and includes settlement and cross-border payment.

| Blockchain outlook in China

Mr. Wang believes that standardization of the underlying platform, integration into private sectors, and the supervision and regulations will be three important themes for blockchain in the future. Mr. Yao also sees many possibilities for blockchain in data secure storage, data connection, and coordinated production as China recently added data into one of the marketize production factors.

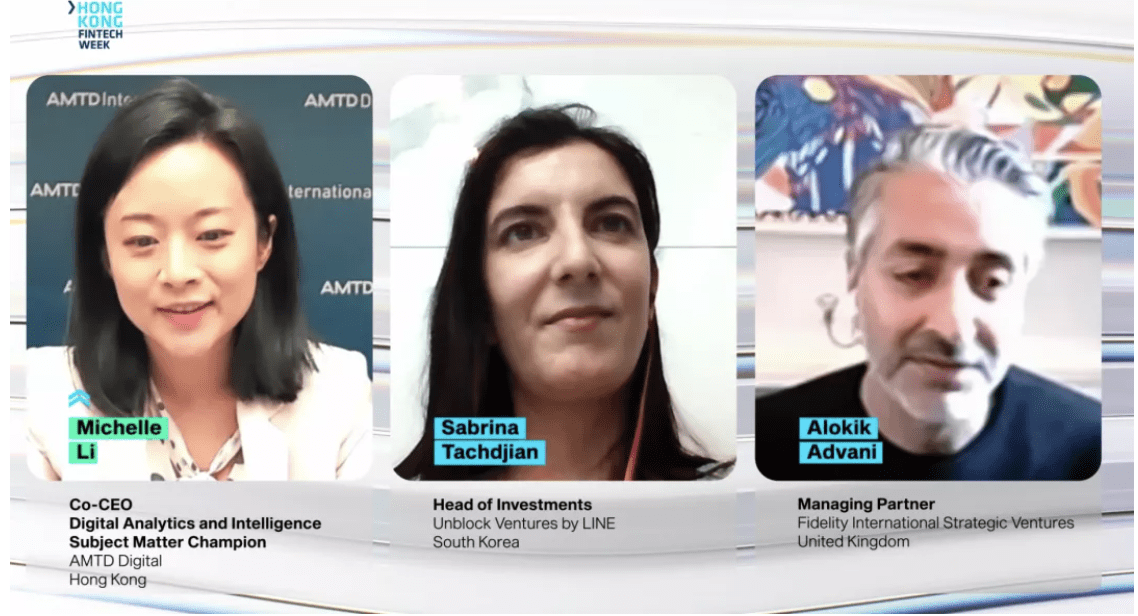

Lastly, Michelle Li, CEO of AMTD Digital, also hosted a “FinTech Strategic Investment” panel discussion. Alokik Advani, Managing Partner of Fidelity International Strategic Ventures, and Sabrina Tachdjian, Head of Investment of Unblock Ventures by LINE Group attended the panel.

(From left to right) First row: Michelle Li, CEO of AMTD Digital; Alokik Advani, Managing Partner of Fidelity International Strategic Ventures; Second row: Sabrina Tachdjian, Head of Investment of Unblock Ventures by LINE

Michelle first introduced that AMTD Digital is a FinTech Ecosystem Platform, having an in-depth understanding of Asian virtual bank landscape. AMTD’s subsidiaries include Airstar Bank, one of the eight virtual banks in Hong Kong, PolicyPal, a leading InsurTech company in Southeast Asia, CapBridge Financial, Singapore’s first private equity exchange and integrated private market ecosystem platform, and FOMO Pay, a leading one-stop QR code payment solution and digital banking solution provider in Southeast Asia. Beyond that, AMTD ASEAN Solidarity Fund has always been actively involved in FinTech strategic investment. Collaborating with Xiaomi, AMTD is applying for Singapore virtual bank license.

Sabrina first pointed out blockchain investment could enable professional investors to get hands-on information of the development of the blockchain industry, and help investors to build relationship with the whole ecosystem. In addition, she mentioned that low efficiency of traditional bank does not match the current expectation of customer needs. How to bridge this huge gap is an excellent opportunity for FinTech entrepreneurs.

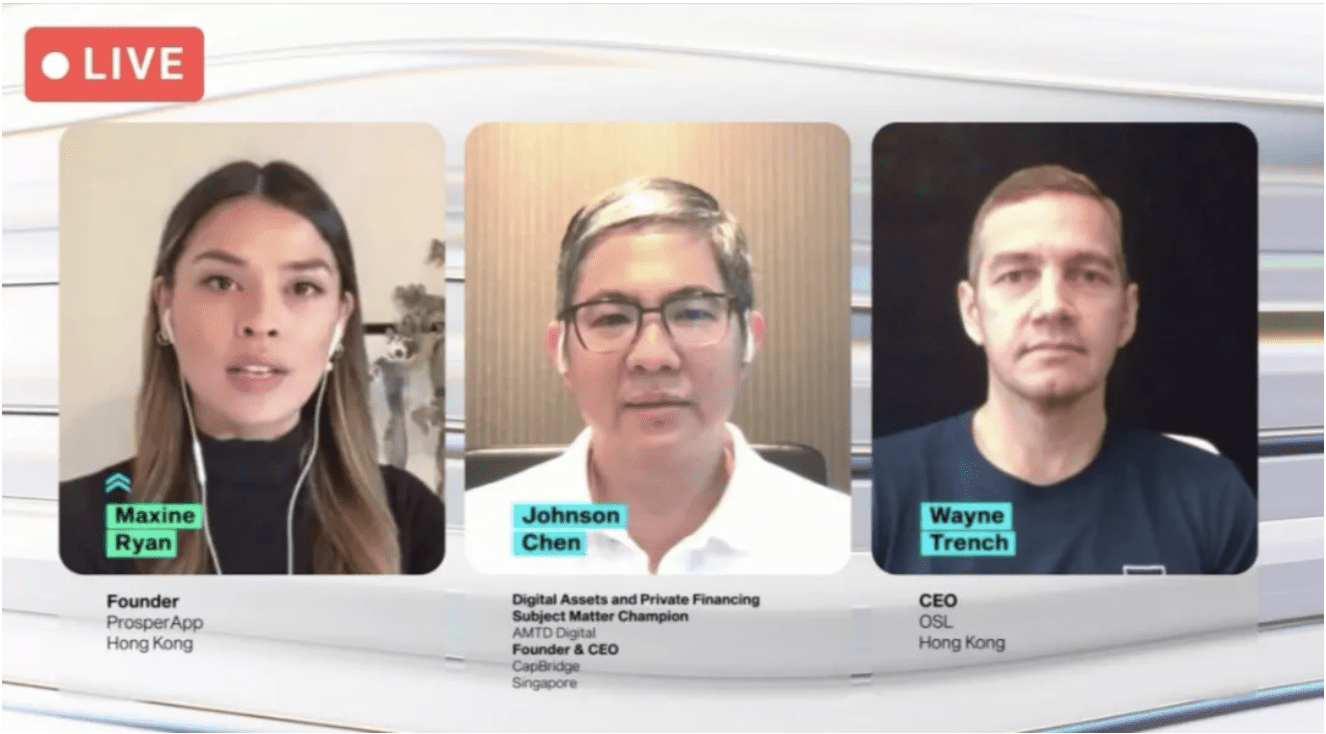

Lastly, on the third day of Hong Kong Fintech Week, Johnson Chen, Digital Assets and Private Financing Subject Matter Champion, Founder & CEO of CapBridge Financial and Wayne Trench, CEO of OSL held an online panel discussion about the transformation of digital asset and regulatory trend in Future Channel. The panel was hosted by Maxine Ryan, founder of ProsperAPP.

Johnson Chen, Digital Assets and Private Financing Subject Matter Champion, Founder & CEO of CapBridge Financial (2nd left); Maxine Ryan, Founder of Prosper AP (1st left); Wayne Trench, CEO of OSL (1st right)

Johnson Chen shared that to follow the global trend of rapid development of digital assets, Monetary Authority of Singapore has already paid close attention to the regulations of digital asset. CapBridge Financial holds a Capital Markets Services License and Recognised Market Operator License. And since 1exchange(“1x”) of CapBridge is the first MAS-regulated private securities exchange in Singapore, investors consider the platform to be more trustworthy. When it comes to the future trend in digitalization of asset, Johnson Chen and Wayne Trench both agrees that, with continuous improvement in digital infrastructure, adopting and embracing blockchain technology and digitalization process will be an irreversible trend in financial industry.

AMTD Digital, as the core pillar of AMTD group, will continuously expand its presence in financial technology industry, and fully leverage the power of artificial technology, big data, and financial technology to provide inclusive, intelligent and green financial services and solutions to all customers.

This year, Hong Kong FinTech Week set up the “Global Fast Track – China Track” to provide more opportunities and resources for promising mainland startups to enter Hong Kong financial market and go global. Michelle Li, CEO of AMTD Digital, was invited as a judge for the finals and to share her thoughts in the “The Innovative Cooperation Between Large Corporations and Startups” panel discussion.

Michelle Li, CEO of AMTD Digital (mid of bottom); Andrew Huang, Partner and FinTech Leader of KPMG China (top right); David Ye, Co-Founder, Chairman and CEO of Rong360.com (bottom right); Wong Chiyan, Head of Business Strategy Office of Chow Tai Fook (bottom left); Wang Xiaorui, Head of Strategic Development of RGAX Asia Pacific (mid of top); Sabrina Chang, Vice President of 36Kr Global Research (top left), as moderator

Michelle said, “AMTD has been investing in FinTech sector since 2016. AMTD does not only provide funding support, but also commit to enabling these startups and help them achieve fast growth and oversea expansion. AMTD believes that “embracing the compliances” is the core essence of FinTech development and thus has continuously invested in acquiring licenses over the years. As the key partner for Xiaomi’s oversea expansion in FinTech sector, AMTD and Xiaomi jointly acquired the virtual banking license in Hong Kong. AMTD is also equipped with the accessibility to the license resources through its subsidiaries in InsurTech, e-payment and digital asset exchange in Singapore. By connecting these businesses, AMTD Digital strives to build a one-stop, cross-market, comprehensive digital financial services platform to enable the digitalization of the medium-sized enterprises.